Bitcoin ETFs

A list of brokerages that offer Bitcoin ETFs.

Robinhood

Popular and well-known exchange based in the USA. Buy & trade with ACH transfers. Also offers U.S. Bitcoin ETFs like IBIT and FBTC.

Public

US-regulated broker offering commission-free trading of Bitcoin ETFs and Bitcoin. Registered with FINRA/SIPC with up to $500k SIPC protection. Supports direct Bitcoin purchases but does not allow withdrawals.

Table of Contents

Where to Buy Bitcoin ETFs

| Broker | BTC ETFs | Buy BTC Directly |

|---|---|---|

| Yes | Yes | |

| Yes | Yes | |

| Yes | Yes | |

| Yes | No | |

| Fidelity | Yes | No |

| Charles Schwab | Yes | No |

| SoFi | Yes | No |

Platforms like Robinhood and eToro offer unique advantages as hybrid brokers - they support both spot Bitcoin ETF trading and direct cryptocurrency purchases on a single platform. Traditional brokers like Fidelity, Charles Schwab and Interactive Brokers only offer ETF trading without direct crypto access. For most retail investors, the hybrid platforms provide more flexibility, though traditional brokers may offer additional investment products and services.

WARNING: Bitcoin ETFs carry significant risks investors should understand. The crypto market remains highly volatile and susceptible to manipulation. ETFs also face ongoing regulatory uncertainty from the SEC. Additionally, since ETF providers rely on custodians to hold the actual Bitcoin, security breaches at either the provider or custodian could impact ETF holders. Consider these risks carefully before investing and consult with a financial advisor. This page is not financial advice.

Steps to Buy Bitcoin ETFs

- Open a brokerage account - Choose from brokers like Robinhood, eToro, or traditional firms like Fidelity and Charles Schwab that offer Bitcoin ETFs.

- Compare Bitcoin ETF options - Look at expense ratios (fees), trading volume, and assets under management. Popular options include IBIT, FBTC, and BITB with fees around 0.20-0.25%.

- Place your trade - Enter the ETF ticker symbol (e.g. IBIT), number of shares, and order type (market or limit order). Most brokers now offer commission-free ETF trades.

- Monitor your investment - Track performance through your brokerage account and rebalance as needed based on your investment goals.

Bitcoin ETF Fees Comparison

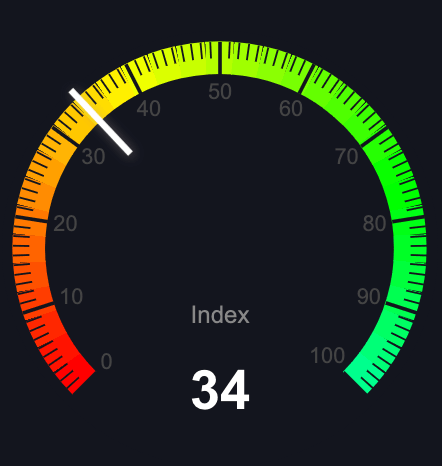

ETF Fee Calculator

We built this tool to help you calculate the total fees you'll pay for holding a Bitcoin ETF over time. This assumes Bitcoin appreciates 30% annually (warning: past performance does not guarantee future returns).

| ETF name | Symbol | Fee (Annual) |

|---|---|---|

| iShares Bitcoin Trust | IBIT:NASDAQ | 0.25% |

| Grayscale Bitcoin Trust | GBTC:NYSE | 1.50% |

| Fidelity Wise Origin Bitcoin Fund | FBTC:CBOE | 0.25% |

| Ark 21Shares Bitcoin ETF | ARKB:CBOE | 0.21% |

| Bitwise Bitcoin ETF | BITB:NYSE | 0.20% |

| Grayscale Bitcoin Mini Trust | BTC:NYSE | 0.15% |

| VanEck Bitcoin Trust | HODL:CBOE | 0.20% |

| Valkyrie Bitcoin Fund | BRRR:NASDAQ | 0.25% |

| Franklin Templeton Digital Holdings Trust | EZBC:CBOE | 0.19% |

| Invesco Galaxy Bitcoin ETF | BTCO:CBOE | 0.25% |

| WisdomTree Bitcoin Fund | BTCW:CBOE | 0.25% |

| Hashdex Bitcoin ETF | DEFI:NYSE | 0.90% |

Note: HODL is waiving all fees until January 10, 2026 or until the fund reaches $2.5 billion in assets, whichever comes first.

Bitcoin vs Bitcoin ETFs

| Comparison | Bitcoin ETFs | Bitcoin |

|---|---|---|

| Expense Ratio | Annual management fee between 0.20-1.50% charged regardless of trading activity | No annual fees, though hardware wallets for secure storage can cost $50-200 as a one-time expense |

| Tax Treatment | Can be easily held in tax-advantaged accounts like 401(k)s and IRAs through standard and traditional brokerages | Requires specialized self-directed IRA setup for tax-advantaged treatment; otherwise subject to capital gains tax |

| SIPC Insurance | Protected up to $500,000 by SIPC against broker failure (not market losses) | No SIPC or FDIC protection; self-custody requires personal responsibility for security |

| Price Tracking | Generally tracks Bitcoin price but may trade at slight premiums or discounts; potential tracking error | Direct exposure to Bitcoin price with no tracking error or premium/discount concerns |

| Regulatory Oversight | SEC-regulated investment vehicles with standardized reporting and investor protections | Limited regulatory oversight; operates largely outside traditional financial systems |

Advantages of Bitcoin ETFs

- Simplicity - Buy through existing brokerage accounts without needing new crypto exchange accounts

- Tax Benefits - Easy to hold in tax-advantaged accounts like IRAs and 401(k)s

- Regulatory Protection - SEC oversight provides investor protections and standardized reporting

- High Liquidity - Major ETFs like IBIT and FBTC offer excellent trading liquidity

- Familiar Structure - Uses existing brokerage infrastructure and trading mechanisms

- Options Trading - Ability to trade options on Bitcoin exposure (US only)

Disadvantages of Bitcoin ETFs

- Counterparty Risk - Must trust the ETF provider to properly secure and manage the Bitcoin

- Management Fees - Annual fees between 0.20-1.50% reduce long-term returns

- Trading Costs - May incur broker commissions and trading fees

- No Direct Ownership - Cannot withdraw or use the underlying Bitcoin directly

- Tracking Error - ETF price may deviate slightly from actual Bitcoin price

- Limited Trading Hours - Only tradeable during stock market hours unlike 24/7 Bitcoin markets

ETF Alternatives - Mining Stocks

While Bitcoin ETFs provide one way to gain exposure to the cryptocurrency market, some investors prefer to invest in the companies "selling the shovels" - similar to how many invested in mining companies during gold rushes. Bitcoin mining stocks represent companies directly involved in Bitcoin mining operations.

| Company Name | Ticker |

|---|---|

| Bitfarms | BITF |

| Bit Digital | BTBT |

| Cipher Mining | CIFR |

| Cleanspark | CLSK |

| Core Scientific | CORZ |

| Hive Blockchain | HIVE |

| Hut 8 Mining Corp | HUT |

| Marathon Digital | MARA |

| Riot Platforms | RIOT |

Why ETFs Are Popular Alternative Investments

For many investors, Bitcoin ETFs offer an attractive middle ground between traditional investments and direct cryptocurrency exposure. While investing in Bitcoin directly requires setting up crypto exchange accounts and managing digital wallets, ETFs provide a more accessible entry point through existing brokerage accounts.

Alternative investment options include:

- Cryptocurrency Stocks - Investing in public companies involved in crypto technology

- Bitcoin Futures - Derivative contracts based on Bitcoin's future price

- Mining Stocks - Companies operating Bitcoin mining facilities

- Blockchain ETFs - Funds focused on blockchain technology companies

However, investors should note that cryptocurrencies and related investments are still relatively new and carry significant risks. These alternative investments are typically intended for sophisticated investors who can handle potential losses of principal.

Bitcoin ETFs Approved in USA

On January 10 of 2024, the SEC approved 11 US Bitcoin ETFs, marking a historic moment for cryptocurrency investment.

Pre-Approval Drama

On January 9, 2024, the SEC's Twitter account was compromised, posting a false approval announcement. SEC Chair Gary Gensler quickly clarified that the account was hacked and no approval had been granted at that time.

Official Approval

The next day, the SEC officially approved the spot Bitcoin ETFs, requiring sponsors to provide comprehensive disclosures and maintain investor protections.

| ETF/Fund | Approval Date |

|---|---|

| Ark / 21Shares | January 10 |

| Bitwise | January 10 |

| Blackrock / iShares | January 10 |

| VanEck | January 10 |

| Wisdomtree | January 10 |

| Invesco Galaxy | January 10 |

| Fidelity | January 10 |

| Valkyrie | January 10 |

| Pando Asset | January 10 |

| Franklin Templeton | January 10 |

Frequently Asked Questions

If I Bought Bitcoin

See how much you would have made if you bought Bitcoin in the past.

Exchange snapshots

Robinhood

| Robinhood snapshot | |

| Minimum Deposit | $1 |

| iOS app score |

4.2

Official rating from the iOS App Store as of November 18, 2024.

|

| Android app score |

4.2

Official rating from the Android Play Store as of November 18, 2024.

|

| Deposit Methods | ACH, Debit Card, Bank Account, Wire Transfer |

| Review | Read our review |

Public

| Public snapshot | |

| Minimum Deposit | $1 |

| Deposit Methods | - |

Coinbase vs

Coinbase vs

Kraken

Kraken

Uphold

Uphold

Gemini

Gemini

Bitbuy

Bitbuy

MoonPay

MoonPay

Binance

Binance

Bitstamp

Bitstamp

River vs

River vs

Unchained

Unchained

Strike vs

Strike vs

Bitpanda vs

Bitpanda vs

Cash App vs

Cash App vs