Strike vs Coinbase: Which is Best? [2025]

Key differences

- Strike has much lower fees than Coinbase.

- Coinbase supports many cryptocurrencies, Strike is Bitcoin and USDT only with lightning support.

- Strike offers more specific features for Bitcoiners, like Bitcoin bill pay.

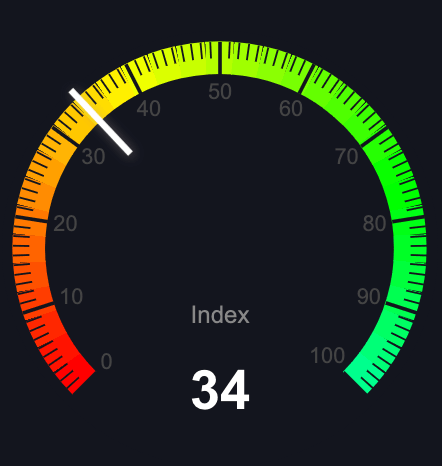

Strike vs Coinbase Fees Calculator

We built this fee calculator to help you compare the fees of Strike and Coinbase.

Enter the amount you want to buy and we'll show you the estimated fees for each exchange.

Strike vs Coinbase in Comparison

Description

Fast, secure US-based exchange with high limits.

Coinbase is a popular global crypto exchange with over 240 cryptocurrencies supported.

Supported Countries

Available in 65+ countries including United States, El Salvador, Argentina, Costa Rica, Philippines and more. Send Globally feature available in 12+ countries.

Available in over 100 countries globally. Full features in most of US including debit cards, staking, instant transfers and futures. Strong support in UK, Europe and parts of Asia with some restrictions. Not available in Singapore or OFAC-sanctioned countries. ID verification required.

Supported Cryptocurrencies

Bitcoin (BTC) on-chain and Lightning, USDT

Over 240 cryptocurrencies

Fees

- Trading Fees:

- Under $250: 0.99%

- $250 - $2,000: 0.95%

- $2,000 - $5,000: 0.89%

- $5,000 - $50,000: 0.79%

- $50,000 - $500,000: 0.69%

- $500,000 - $5,000,000: 0.59%

- $5,000,000 - $15,000,000: 0.49%

- Over $15,000,000: 0.39%

- Bank transfers: Free

- On-chain BTC withdrawals: Network fee

~2% debit card deposit fee.

- Transaction Fees:

- $0.99 for transactions $10 or lower

- $1.49 for transactions between $10-$25

- $1.99 for transactions between $25-$50

- $2.99 for transactions between $50-$200

- 0.50% spread fee for transactions over $200

Payment Method Fees:- ACH transfers: Free

- Bank account/USD Wallet: 1.49%

- Credit/debit card: 3.99%

- Wire transfers: $10 incoming, $25 outgoing

Payment Methods

Debit Card, ACH, and Wire Transfer

ACH, Wire Transfer, Debit Card, Bank Account, PayPal, Apple Pay, iDEAL, SEPA, Interac e-Transfer, Instant Verification, Google Pay

Do These Exchanges Allow you To Earn Interest on Crypto?

4.70%

Earn 4.70% APY rewards by holding USDC on Coinbase. USDC is fully backed 1:1 by US dollars. Minimum $1.

Mobile App Ratings

iOS Rating: 4.8 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

iOS Rating: 4.7 Official rating from the iOS App Store as of November 18, 2024.

Android Rating: 4.6 Official rating from the Android Play Store as of November 18, 2024.

Storage

Industry standard security measures including 2FA authentication. Non-custodial Lightning payments. Registered and regulated Money Services Business (MSB).

As a public US company, Coinbase maintains full 1:1 reserves of customer assets with no lending. Their platform features industry-leading security including mandatory 2FA, multi-approval withdrawals via Coinbase Vault, and 24/7 monitoring. Over 10 years of experience and regular third-party audits.

Have These Exchanges Been Hacked Before?

No publicly reported security incidents

No. Has never lost customer funds in any way.

Official Site

Exchange Review

No review available

"Love the hourly auto buy feature on this app. Invite some friends and go fee free. Auto buy for a week and go fee free. Otherwise fees are super low compared to everything else. Will never buy BTC on the other platforms again. Highly recommend."

- Real user review from iOS App Store, Android Play Store or Trustpilot

No review available

"I mistakenly sent my crypto to the wrong wallet at Coinbase. The team at Coinbase was able to retrieve it and credit to my account within a week. I am quite impressed with their communication, instruction, and result! I'm so relieved. Thank you so much, Coinbase Support!"

- Real user review from iOS App Store, Android Play Store or Trustpilot

Kraken

Kraken

Uphold

Uphold

Gemini

Gemini

Bitbuy

Bitbuy

MoonPay

MoonPay

River vs

River vs

Robinhood vs

Robinhood vs

Bitpanda vs

Bitpanda vs

Cash App vs

Cash App vs

Binance

Binance

Bitstamp

Bitstamp

Unchained

Unchained